30 Mar Profit vs. Growth: What are the differences?

What defines success for a business? For most of the last century, it was profits. The leading enterprises of the world were ones that fashioned a profitable business model and leveraged it over time. Profitability as the key measure of business success was akin to a law of physics – like gravity – a foundational assumption which we all take as given: you have to deliver profits to create long term shareholder value. But what was once a natural feature of the competitive landscape has now become a trap for people and companies who are not able to adapt to a new landscape and change their focus.

Two big, well-known tech companies neatly illustrate this shift. Consider Microsoft under Steve Ballmer. The former CEO believes that delivering profits is the main measure of a company, and he’s justly proud of the $250 billion of profits Microsoft generated during his tenure over 14 years. Then consider Amazon, the first big company to deliver long term stock growth for the better part of two decades with essentially no profit to show for it. The contrast could not be clearer: Amazon – fearlessly making big, risky bets like a serial entrepreneur; and Microsoft, eschewing disruptive innovation in favor of remaining the “fast follower” it has always been, wringing profit from previously proven technologies.

Coming from a profitability-focused paradigm, it is not surprising that Ballmer was critical of Amazon, Microsoft’s Seattle neighbor, and its focus on growing and expanding its range of services instead of profits. From the old paradigm perspective, it was as if Amazon was attempting to defy gravity. But the contrast has come to favor Amazon. Many people in Silicon Valley see Microsoft as irrelevant today, while Amazon investors focus on its future growth. Profits appear more and more as a lagging indicator of yesterday’s innovations. Around three-quarters of Microsoft’s profits come from two extremely successful products that the company introduced in the 1980s and 1990s: the Windows operating system and Office productivity suite. As Paul Graham, co-founder of Y Combinator wrote, “Microsoft cast a shadow over the software world for almost 20 years starting in the late 80s … But it’s gone now. I can sense that. No one is even afraid of Microsoft anymore. They still make a lot of money … But they’re not dangerous.” And that was in 2007.

Amazon keeps margins razor thin, as part of its mission to become the best place to buy just about everything. As CEO Jeff Bezos has said, “Your margin is my opportunity.” Amazon is maniacally cost-focused, but rather than letting benefits flow to profit, they pass them along to their customers. Also, Amazon needs to spend a lot as it grows its existing and new businesses. For example, as part of its same-day delivery service, it is dramatically expanding its distribution centers and hiring thousands of people in California and other states. It spends its earnings on creating and expanding new products (mobile phones, tablets) and continuing to build out Amazon Web Services (AWS). In 2006, AWS began offering IT infrastructure services to businesses in the form of web services – now commonly known as cloud computing. Today, AWS powers a growing universe of more than a million active customers in 190 countries around the world.

This can be very hard to do given the incredible pull of profitability in driving strategy. And therein lies the “trap”: a company’s success at generating profits can prevent the investment in innovation it needs. Profit-focused companies focus on scaling efficiency and cutting costs, and miss new opportunities. While Ballmer was focusing key resources on a new version of Windows (“Longhorn”) to defend Microsoft’s core product line, he missed big opportunities in search, social media, and phones. (Both the Bing search engine and the Windows Phone were just too late to mount serious challenges to Google, on the one hand, and the iPhone and Android, on the other.) Microsoft seemed to become rigid and bloated, and had difficulty with mergers and acquisitions. A friend of ours said recently, “In its early days Microsoft took more risks than a pirate; now they take less risk than an insurance company.”

A New Model for Growth

What lessons can we learn from Microsoft’s and Amazon’s differing emphasis on profits? How do you know when to focus your attention on defending a cash cow, and when to worry about winning in the future?

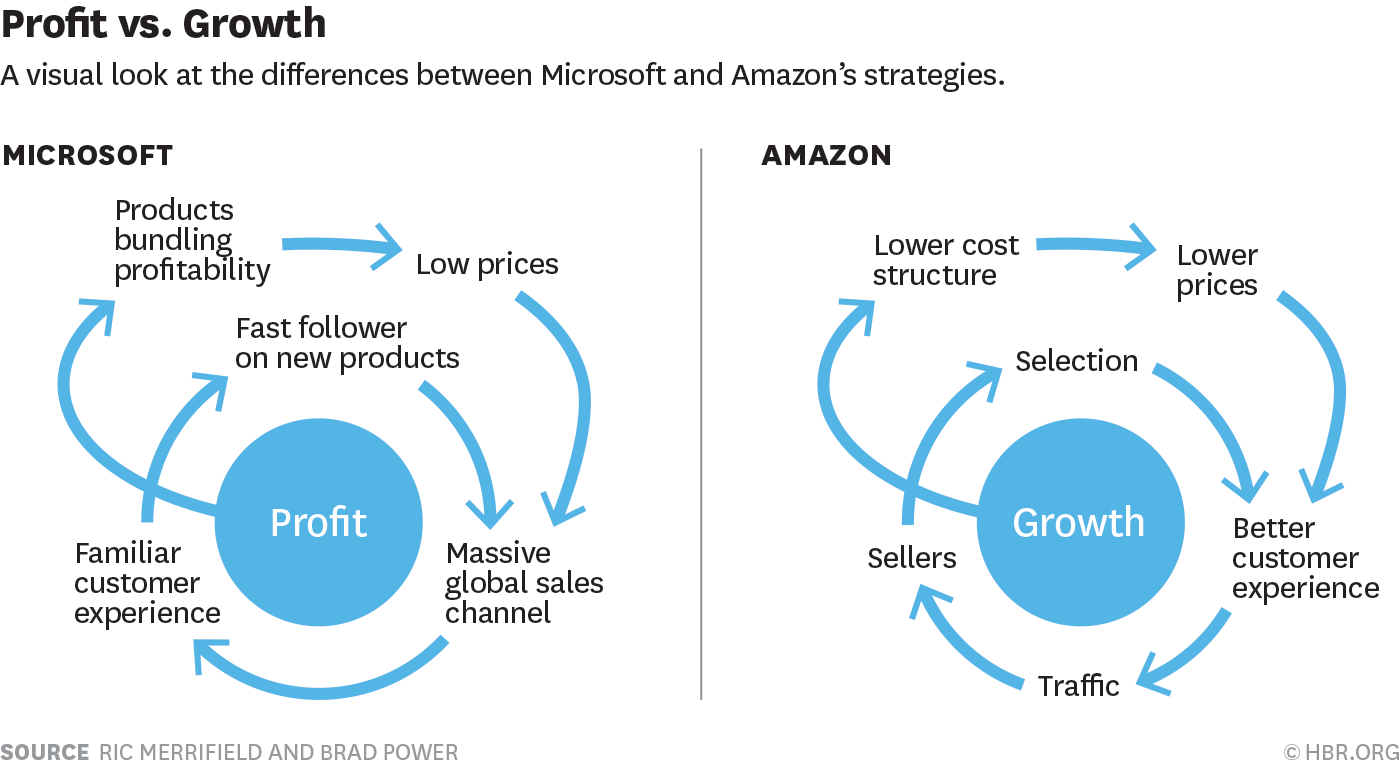

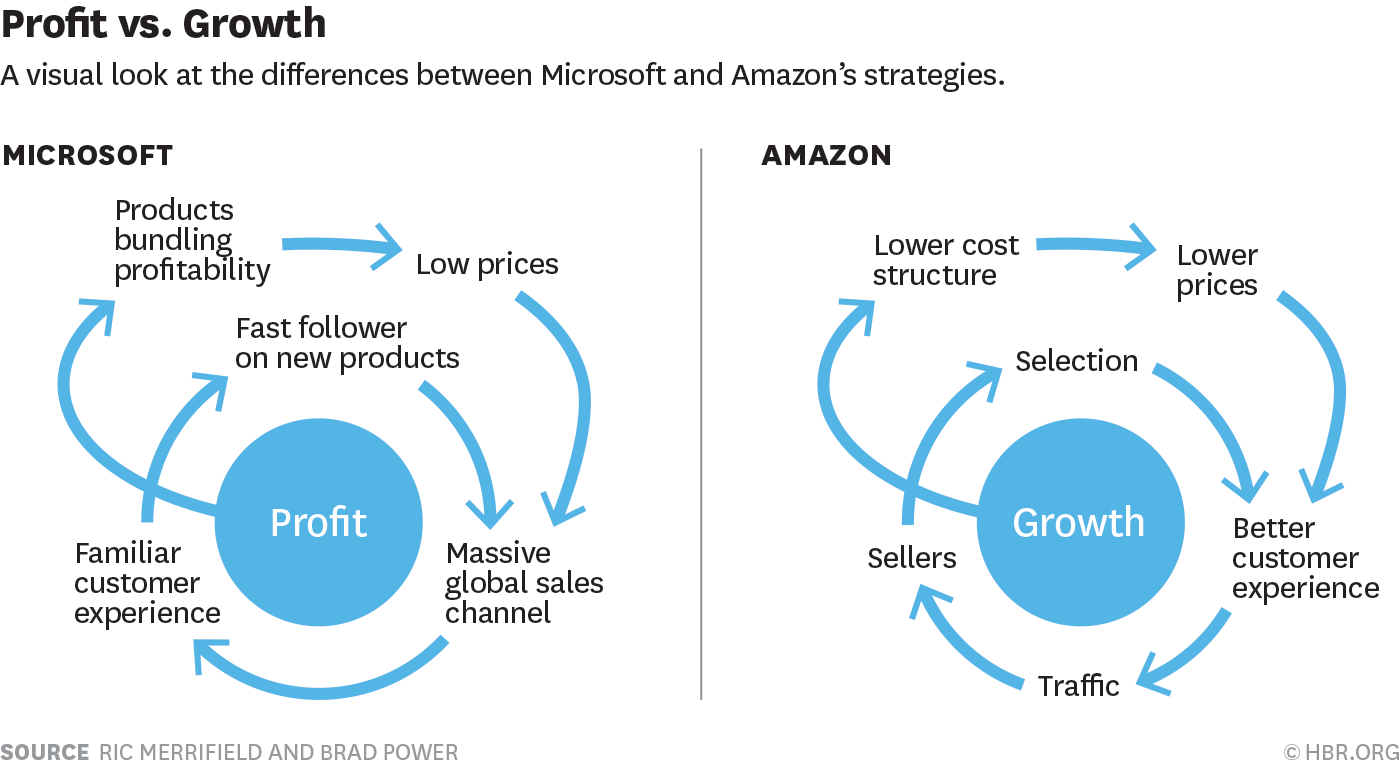

Despite its scale, Amazon still thinks and acts like a startup. It has maintained its openness to invention that was characteristic of its beginnings. It is focused on growth and continues to create new things. It is expanding its core business by increasing selection (the range of products it sells) and improving the customer experience (for example, Amazon Prime and next day and same day service). Here’s a rough illustration of this new model compared to Microsoft’s.

Microsoft’s model, which reflects its definition of success, revolves around profits. As our friend said, it wasn’t always this way – earlier in its corporate life, the Microsoft model no doubt looked very much like the Amazon one. But Amazon has found a way to sustain its more entrepreneurial model, growing its business at the edge, with services like AWS, and products like the Kindle and Fire. Amazon still has the founding phase zeal for creating and building. It measures its success by revenue growth and satisfied customers, not big profits.

High tech companies provide a useful laboratory to explore the tension between profit and innovation since high tech product lifecycles are short and shrinking. As companies like Microsoft succeed and grow to be very big, they tend to become stewards of the formulas that got them their success, and they focus on profitability. They milk their cash cows. But an excessive focus on profits can compete away investments that could lead to creating the next big thing.

Can Microsoft escape from the profit trap, recapture its founding spirit, and start taking more risks? Or does it feel there is no benefit to reducing margin on many of their products, as Amazon does, since it will not increase share? There are some interesting recent developments. The traditional shrink wrapped software business model surrounding Microsoft’s core Windows and Office products has been breached. Current CEO Satya Nadella seems to be inching forward by introducing more reasonably priced “Software-as-a-Service” (cloud) versions of Windows and Office, at the expense of profit. And it appears that Nadella has a renewed interest in taking risks and making big bets, such as the virtual reality HoloLens. Might Microsoft be willing to concede their traditional profit margins to win in this new category, effectively taking a page from the Bezos playbook? Time will tell.

Source:

Too Much Profit Can Doom Your Company

AUTHOR

- Brad Power

- Ric Merrifield

SUBJECT

- Competitive strategy

- Innovation

FORMAT

Graphic

PUBLICATION DATE

Jun 01, 2015