07 Jun How the Market Rewards Disruptors

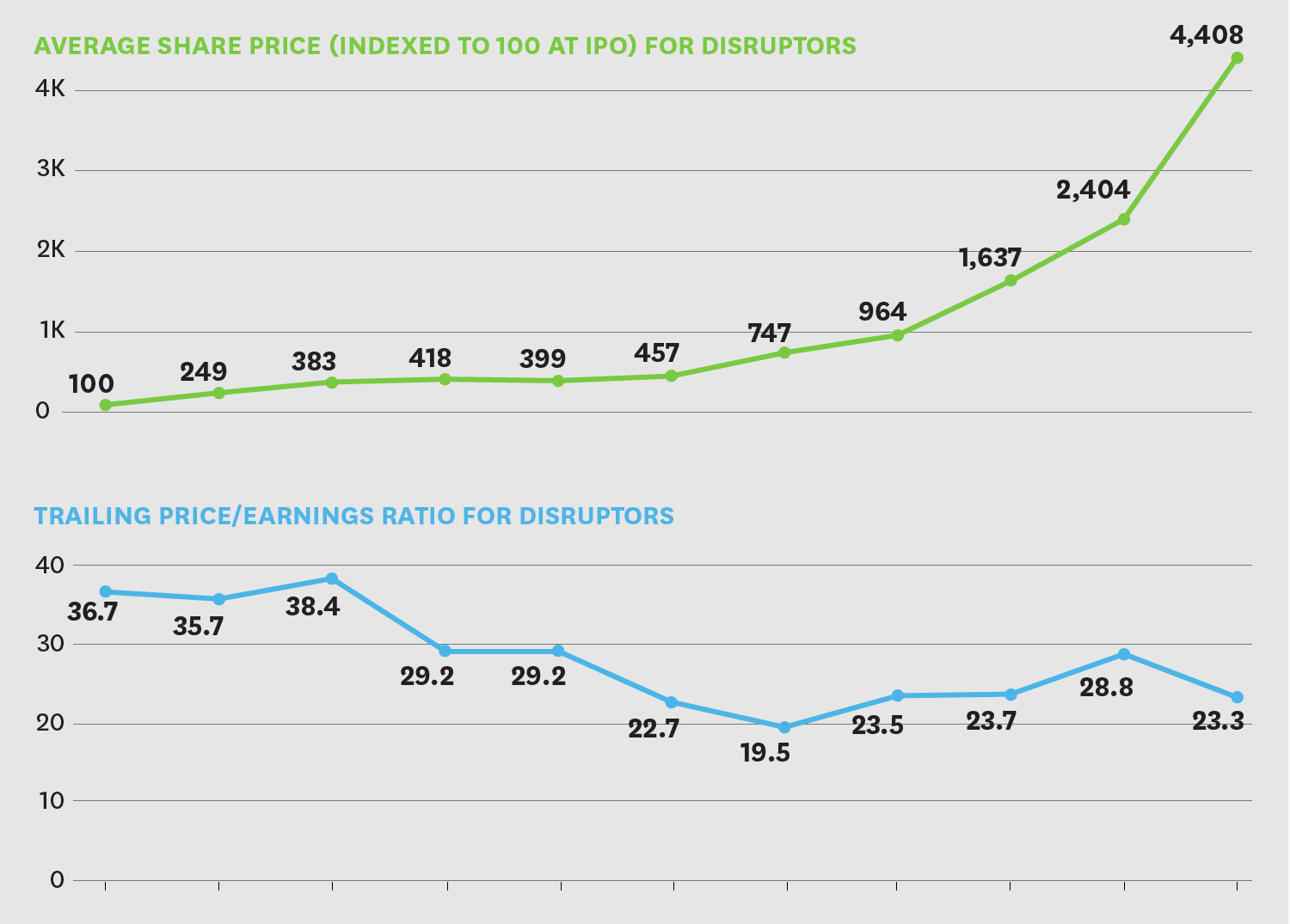

Annual P/E ratios for disruptive companies are far higher than historical levels, leading analysts to believe their shares were overpriced. Yet the extraordinary performance of disruptive companies in the market suggests that their shares were persistently underpriced.

The stacks of M&A literature are littered with warnings about paying too much, and for good reason. Many an executive has been caught up in deal fever and paid more for an LBM deal than could be justified by cost synergies. For that kind of deal, it’s crucial to determine the target’s worth by calculating the impact on profits from the acquisition. If an acquirer pays less than that, the stock price will increase, but only to a slightly higher plateau, with a gentle upward slope representing the company’s weighted-average cost of capital, which for most firms is about 8%.

In contrast, consider the exhibit “How the Market Rewards Disruptors,” which charts the average earnings multiple of 37 companies we’ve determined to be disruptive in the 10 years after they went public. Annual P/E ratios for this group are far higher than historical levels, leading analysts to believe their shares were overpriced. Yet investors who purchased at the time of the IPO and held the stock for 10 years realized an astounding 46% annual return, indicating that the shares were persistently underpriced, even at these “high” multiples.

FROM

The Big Idea: The New M&A Playbook

AUTHOR

Clayton M. Christensen, Richard Alton, Curtis Rising, and Andrew Waldeck

SUBJECT

Disruptive innovationGrowth strategyMergers & acquisitions