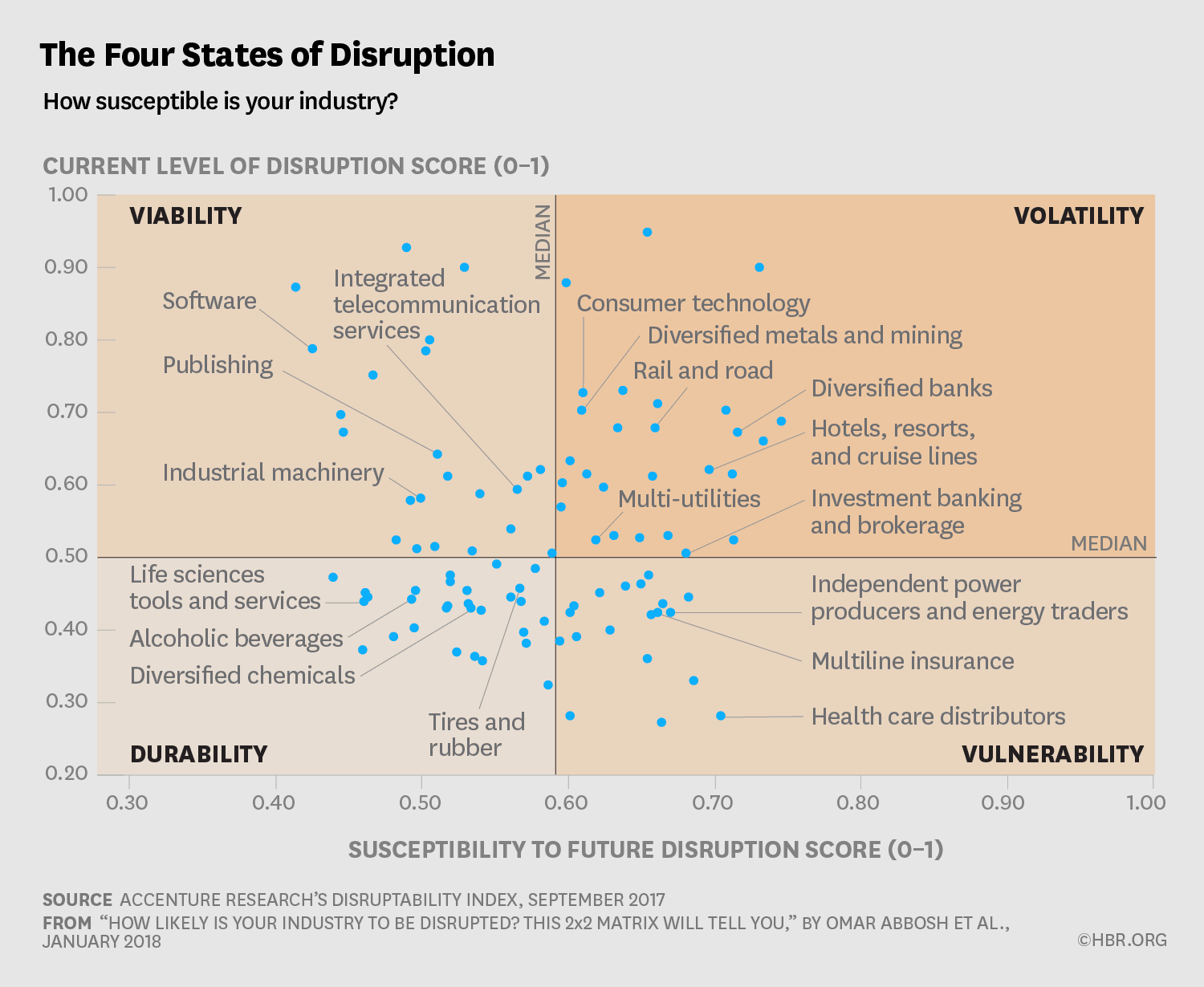

The Four States of Disruption

The topic of industry disruption is rife with misconceptions. To help business leaders better understand the landscape, this index measures an industry’s current level of disruption as well as its susceptibility to future disruption. It positions 20 industry sectors — and 98 segments within those...